With the end of the year coming, many equine owners may be considering donating one of their horses to a university or therapeutic riding program for a tax write-off. There are several important facts you need to know before you decide to consider this for tax purposes.

GoHorseShow talked about the process with the NCAA Equestrian coach at Oklahoma State University, Larry Sanchez. We additional spoke with a few Certified Public Accountants (CPA’s), as well as Financial Planner and Attorney, Carrie Russom Quraishi of Jonesboro, Arkansas who happens to be a World and Congress Champion herself.

For this article, we will focus on horses that are appropriate to be donated to NCAA equestrian teams as well as therapeutic riding programs. According to Sanchez, older more mature show horses in ages ranging from five to 13 are preferable. Horses should have a proven show record in classes such as the equitation on the flat, equitation over fences, western horsemanship and reining. Young horses that need training would not be considered for these types of programs. There are other colleges and universities like University of Findlay and North Central Texas College that have training programs that may consider taking young green horses that need additional training.

Sanchez encourages those individuals interested in donating their horse to his program to submit a video, especially if he is not familiar with the horse or has not seen the horse perform on the show circuit. If the horse has the potential to work with his team, then, he will usually take the horse for a trial period of 30 to 60 days. During this time, the horse’s temperament and soundness will be considered. This is common with most programs.

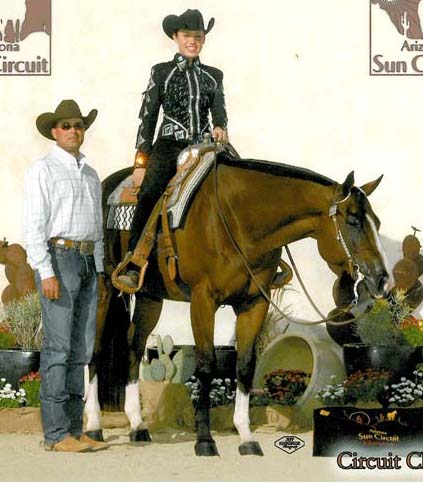

“We want horses that will be here for the long haul,” Sanchez tells GoHorseShow. “Many times, college programs are a great way to transition horses to a more laid back and less intense show career. Horses that may be past their prime or might not be able to jump quite as high could be a good fit on NCAA equestrian teams.” (Pictured left–Texas A&M rider Carey Nowacek at 2011 Varsity Equestrian National Championships)

“We want horses that will be here for the long haul,” Sanchez tells GoHorseShow. “Many times, college programs are a great way to transition horses to a more laid back and less intense show career. Horses that may be past their prime or might not be able to jump quite as high could be a good fit on NCAA equestrian teams.” (Pictured left–Texas A&M rider Carey Nowacek at 2011 Varsity Equestrian National Championships)

Sanchez adds, “The horses get ample breaks and are turned out more often with other horses which helps them mentally and extends their career. Their show coat isn’t as important since the focus is on the rider, so I think it is a great option for many older show horses.”

World Champion Lindsey McMullen, who is a freshman on the OSU equestrian team, recently donated her old show horse, Hot Jazz Dot Com (Ralph). Sanchez says this Congress Champion is an excellent example of the type of horse that they consider for their program.

“Ralph has had an extensive amount of training, and he is a very talented individual. While he has all the parts, he is not a push button or easy horse to ride, so the more talented riders will be able to shine and stand out on a horse like him.”

As far as horses that would be appropriate for therapeutic riding programs, the horses don’t need to be as well trained but they must be calm, quiet, and safe around the riders; many who are mentally and physically disabled. Saddle Up!, a therapeutic riding program located in Franklin, Tennessee says that they are always looking for quality horses but the requirements are strict and time consuming.

“It takes a special horse to be able to do this demanding job,” Saddle Up! Development Coordinator, Tina Carpenter says. “What we do is not just a pony ride. It requires a horse that has good physical, mental, and behavorial characteristics. We have a variety of horses–for example, former polo, dressage, and pleasure horses. Almost all of our horses have been donated, and we are grateful to the individuals who have chosen to give their horses to our program.”

“It takes a special horse to be able to do this demanding job,” Saddle Up! Development Coordinator, Tina Carpenter says. “What we do is not just a pony ride. It requires a horse that has good physical, mental, and behavorial characteristics. We have a variety of horses–for example, former polo, dressage, and pleasure horses. Almost all of our horses have been donated, and we are grateful to the individuals who have chosen to give their horses to our program.”

Since most of these horses are former high dollar show horses, it is appropriate for the donor to get an appraisal done by a licensed equine appraiser or a letter written by a qualified industry professional. The appraisal must evaluate the horse and determine fair market value for the horse.

Besides the appraisal letter, there should also be a contract signed between the non profit and the donor agreeing to the exact terms of the agreement. Most contracts include issues such as the trial period; first right of refusal to take the horse for retirement; how long the nonprofit is required to keep the horse before they are allowed to sell it; and the program’s responsibilities regarding adequate care for the horse’s well being, to include veterinary, farrier, and nutritional care.

We have provided a list of donation tips below.

Helpful Donation Tips:

• Make sure the organization is a nonprofit charity qualified under the Internal Revenue Service (IRS) Code 501(c)(3) — exempt from taxation because its income derives from its educational, religious, charitable, or humanitarian purpose — and your horse will be used by the organization in accordance with its charitable purpose. If you are unsure about a nonprofit’s status, ask to see its “statement of purpose” and “IRS exemption certificate.” You can also contact the IRS for a listing of qualified 501(c)(3)s.

• Establish your horse’s reasonable worth or fair market value (FMV) at the time of the gift. If you believe he’s worth more than $5000, you must have an appraisal done by a qualified equine appraiser, including a description of your horse, the date of the gift, the date of the appraisal, terms of any agreement about the use of the horse, the appraiser’s identity and qualifications, the method used to determine the horse’s value, and a statement that the appraisal was prepared for income-tax purposes. Even if you don’t think he’s worth that much, there are advantages to having in your records a letter of valuation from a knowledgeable horse professional, such as a trainer.

• Do the paperwork at the time of the gift. Make sure you fill out the IRS Form 8283 according to the appraised value of your horse and also write a clear and concise contract between you and the nonprofit.

We have compiled some question and answers regarding IRS rules and tax information that may be beneficial to our readers.

Donation FAQ’s

Q: Is there an IRS requirement of how long the program or university needs to keep the horse before they can sell it to make sure the donor won’t have problems with their write off?

A: If your organization disposes of property for which it signed a Form 8283 within three years after receiving a contribution, the organization is required to file Form 8282 with the IRS. Form 8282 must be filed within 125 days after the date your organization disposes of the property, and a copy of the form must be provided to the original donor. For example—if you get the horse appraised for $40,000 and then use that amount to get a write-off and then the non-profit sells it before three years for $10,000 then the donor would have to recapture a portion of their prior year deduction taken (i.e. declare taxable income).

Q: If you get a horse appraised for let’s say $40,000—what amount of that can you write off?

A: The amount of your deduction for charitable contributions is limited to 50% of your adjusted gross income, and may be limited to 30% or 20% of your adjusted gross income, depending on the type of property you give and the type of organization you give it to. The 50% limit applies to the total of all charitable contributions you make during the year. This means that your deduction for charitable contributions cannot be more than 50% of your adjusted gross income for the year. For most individuals the 50% rule will apply. However, if the horse is considered a business asset or capital gain property, the donation is usually limited to 30% of AGI.

Since GoHorseShow.com is not an expert in tax law and every nonprofit has their own requirements; it is wise to contact the program you may be considering to find out their requirements and also to consult your accountant to structure your contract in a way that gives you the most tax benefits. We would like to thank Carrie Russom Quraishi for her help in clarifying the IRS tax requirements.